First off, if you are not trading the Covered Call strategy then it’s time to find out why it is such a valuable component of any investor’s toolkit.

To get right to the bottom of line of why a Covered Call is so powerful, think about the analogy of purchasing an investment property. As an investor you purchase the property with the hope that it will appreciate in value. But there’s no guarantee that will happen. In fact, a sophisticated investor usually doesn’t buy just for appreciation; the sophisticated investor buys for cash flow.

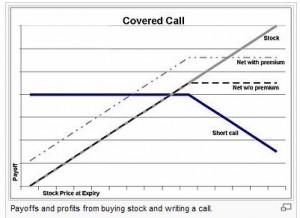

Similarly, when you buy a stock, you might hope the stock will go up in value but why not benefit from a constant cash flow stream too? That is what the Covered Call allows you to do. Not only do you enjoy the stock appreciation when it takes place but you also enjoy a stream of steady cash flows each and every month to mitigate risk in the interim period.

Covered Call Risk Graph – Courtesy of Wikipedia.org

The Covered Call is in many ways superior to relying on a dividend from a dividend-paying stock because you can create the frequency of payouts and indeed the amounts yourself. You don’t have to rely on whatever a company decides is an appropriate payout as part of a dividend.

Of course, there is a downside that if the stock were to rise rapidly the obligation is to sell the stock at the short call strike price, but typically the rate of return that month is so high that it becomes an attractive short-term return.

So, what is stopping you from learning more about the Covered Call? Come join us at www.MarketTamer.com to get started and we’ll show you much more.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why Shares in Data Center Equipment Company Vertiv Surged This Week

Why Shares in Data Center Equipment Company Vertiv Surged This Week