Back in my childhood years, “Dell” brought to mind one thing: “The Farmer in the Dell” nursery rhyme. When I was in grade school and junior high, Dell Comics was a major purveyor of my (then) favorite reading material. As I moved through high school and college, Dell was a publishing company (it currently publishes softcover books by such writers as John Grisham, Thomas Harris, and bestselling female novelist Danielle Steel). Then, while I served two churches in a suburb of Aurora, IL, I heard of an ambitious college student from the University of Texas (at Austin) who had started up a little business in college dorm room 2713 of the Dobie Center – assembling, selling, and shipping PC upgrade kits. The young man’s name was Michael Dell. Demonstrating the dimensions of his ambition, Dell secured a state vendor license and began winning bids to supply the State of Texas with computers – having thereby discovered the amazing economic power of direct distribution! By 1984, he created a company named “PC’s Limited” (looking back, I suspect he would now have named it “UNlimited”). He soon incorporated as “Dell Computer Corporation” (now “Dell Inc.” (DELL)) with a capitalization cost of $1,000.

We don’t have space (or time) to run through all the ins and outs of Dell’s growth and development since the 1980’s. Let’s just say that, through the 1990’s and the first five or six years of the 21st Century, I knew DELL as the premier supplier of quality desktops and laptops.

By 1987, Michael Dell set up his first operations in Ireland, which obviously set the company on course for even greater things, since by June of 1988, Dell saw an opportunity to “cash in” from his success. He initiated an initial public offering (IPO) of stock (3.5 million shares at $8.50/share) – thereby expanding DELL’s capitalization by $30 million. As DELL continued to grow, by 1992 Fortune Magazine incorporated DELL into its illustrious list of the 500 largest companies. Mr. Dell was just 27 then and therefore became the youngest CEO of a Fortune 500 company! (The first “Mark Zuckerberg”, if you will). By the spring of 2001, DELL’s PC market share of 12.8% made it (officially) the world’s largest PC maker.

However, signs of “kinks in the armor” soon began popping up, as is so often the case within the ageless course of human chronicles. By 2003, management was finding it increasingly more difficult to “meet the numbers” promised to analysts and shareholders. The “keepers of the books” fell prey to the alluring temptation of “fudging” – but mastering the skill of doing that in an undetectable manner is a greater challenge than accurate reporting in accordance with GAAP!

Fulfilling DELL’s worst nightmares, the SEC caught up with DELL by 2005 and ordered an investigation going as far back as the accounting year of 2002. In the midst of this investigation and the continuing challenge of meeting “the numbers”, DELL’s 2006 third and fourth quarter financial reports were delayed – subjecting DELL to the ignominy of de-listing from the NASDAQ. However (no surprise) DELL secured a waiver from NASDAQ. In August of 2007, DELL announced that it was restating earnings from FY 2003 through 2006, and the first quarter of 2007. (The chart below reflects the meteoric rise of DELL stock (closing all-time high was almost $54) followed by troubles during the Dot.com “bubble burst”, a recovery, and another dive once the above accounting irregularities came to light.)

Some will say that Mr. Dell was not responsible for the accounting fraud. However, the iconic advocate of “accountability at the top”, President Harry Truman would remind all that, as President (or as CEO) “the buck stops here”. By July of 2010, Truman’s statement proved prescient, since DELL was charged with accounting and disclosure fraud (failure to be transparent about payments from Intel Corp. (INTC) – costing DELL a cool $100 million fine and Mr. Dell (and a former short-term CEO) $4 million each (the CFO was charged $3 million).

All of this is intended to serve as background for what I prefer to describe as “a scandal” that came to light on February 5th of this year. On that day, Mr. Dell informed the DELL board that he, Silver Lake Partners (a 14-year old private equity firm specializing in leveraged buyouts), and Microsoft (MSFT) had worked for months to develop a buyout proposal, through which they would take DELL private. The offering price was set at $13.65/share. Magnanimously, the buyout troika offered the board a 45-day “go shop” period to explore alternatives.

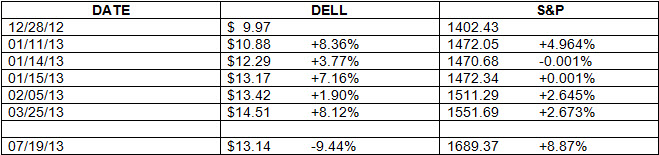

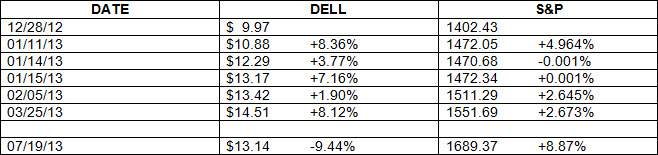

I apologize. I need to qualify something I just wrote. I said that the buyout “came to light” on February 5th. Looking at the DELL price chart (above), I see how naïve and foolish I was. Knowing how vigilant the SEC is about trading on non-public information, I assumed that DELL would spike in February. As you can see below, someone knew a month in advance.

Here is a little table comparing DELL price action with the S&P 500 Index:

Fascinating chart, isn’t it?

Let’s take a “bird’s eye” view of DELL valuation – an objective, arm’s length valuation. I do not pretend to hold expertise in the area of corporate valuation. However, I am familiar with a number of persons who have demonstrable pedigree in that area. In decades past, I purchased funds guided by the legendary Michael Price (Mutual Series funds), the heralded Christopher H. Browne (Tweedy Browne funds), and O. Mason Hawkins (Southeastern Asset Management). I have the utmost esteem for the ability of gentlemen such as them to insightfully recognize investment “value” – especially value to which the Wall Street crowd is blind.

Mason Hawkins is an investor who does his homework in advance and in detail. He has run Southeastern Asset Managers (Longleaf Partners Fund, etc.) for decades. Over the years, Hawkins’ conviction that DELL is greatly undervalued (based in large part on two factors: a) it is reformulating itself into tech services; and b) it’s free cash flow (FCF) is impressive and unrecognized) led him to accumulate enough DELL shares within his funds to become DELL’s second largest shareholder.

Mr. Dell unveiled the company buyout on a Tuesday; by Friday, Hawkins had composed and delivered (and publicized) a long, scathing letter that offered a detailed analysis why DELL shares were worth a minimum of $23.72. Noting that Mr. Dell could have chosen to pay a special dividend of $12/share to shareholders while still leaving the company with the ability to generate FCF between $1.14 and $1.34/share per year. Alternatively, the plan could have involved a spinoff of DELL into two companies – one private and the other (much smaller) public. Given Mr. Dell’s narrow vision of “shareholder value” and the company’s future, Hawkins’ decried DELL’s decision to simply spring a low-ball offer onto shareholders instead of executing any one of the options that Hawkins could so easily envision: “you could gave done [these things] to maximize shareholder value, but you did not, so thus failed to perform your fiduciary duties as required by law.”

Let’s do a quick, “back of the napkin” valuation of DELL as of February:

1) Since 2007, DELL paid $13.7 billion ($7.58/share) for various acquisitions – many of them as part of the plan to transform into a tech services company. DELL’s CFO claimed in June of 2012 that those acquisitions had provided a 15% internal rate of return (IRR);

2) Dell Financial Services reports a book value of $1.72/share;

3) Net cash per share (after deduction for certain debt) was $3.64.

Do you find that fascinating?? Just those numbers alone total $12.94/share. Mr. Dell has the temerity to tell shareholders, with a straight face no less, that $13.65/share is full “fair value” – only ascribing $0.71/share to the value of the rest of the company, including its distribution network, infrastructure, goodwill, and brand!

I can hear some of you say, “OK. I get it. But give the guy a break. He created the company. The company bears his name. He deserves his “pay day”. After all, without Michael Dell, there would be no DELL to buy or sell!”

What a minute! Please recall that Mr. Dell got his “pay day” back in June of 1988, when he made his fortune (valued at $15.9 billion one year ago) and he has been paid richly every year he has served DELL as an officer/director. Mr. Dell’s decision to make his burgeoning computer company a “public” company transformed him from an entrepreneur into (in effect) a “trustee” – obligated by U.S. corporate law to run DELL for the benefit of shareholders. In fact, U.S. law imposes a “fiduciary duty” upon corporate officers and directors – a duty that is strict and inviolate. Here is a succinct description of such duty: [1]

“As fiduciaries, the directors may not put themselves in a position where their interests and duties conflict with the duties that they owe to the company. The law takes the view that good faith must not only be done, but must be manifestly seen to be done, and zealously patrols the conduct of directors in this regard; and will not allow directors to escape liability by asserting that his decision was in fact well founded.”

That is the duty that Mr. Hawkins claims DELL and Mr. Dell failed to uphold. In fact, based on Mr. Hawkins’ valuation figure ($23.72), the offer from Silver Lake and Mr. Dell (that board members want to approve) falls short of “full value” by over 42%! (Expressed a different way, DELL’s full value is 74% higher than Mr. Dell’s offering price.)

Do you have any doubt that Mr. Dell is culpable of violating his fiduciary duty? Despite his legal and rock solid duty to shareholders to maximize their value (not his), he secreted himself with Silver Lake executives over the course of untold months, examining ways they could develop a buyout proposal credible enough to be “sold”, but not so costly as to put Mr. Dell or Silver Lake Partners “at risk”. There was no attempt to secure the services of an objective, third party expert in corporate valuation. However, wouldn’t that have been essential in establishing that Mr. Dell’s offer met a reasonable standard of objectivity (his interest not in conflict with shareholders’ interests)?

The official corporate vote on the buyout proposal was supposed to occur on July 17h in Texas. Experts say that it is highly unusual for official corporate board meetings to get called off, without notice, at the last minute. Besides being rude (because of the inconvenience it causes responsible shareholders), it is also manipulative. However, that did not stop Mr. Dell from postponing the meeting at the last possible minute (because he knew he was one million share votes short of a majority in favor of the buyout). He rescheduled the meeting for one week later (July 24th) in order to provide him time to scour for one million additional “yes” votes. [This reminds me of my old sandlot baseball days — when the player who supplied the bat and ball for the game but doesn’t like the impending outcome would angrily grab the “bat and ball”, disband the game, and send us home, tired and frustrated.]

INVESTOR TAKE AWAY: We will have to wait for the final vote. In the meantime, allow me to suggest what we can learn from this telling Wall Street Saga (or is it strictly a “Texas Tale”):

1) Never trust that corporate executives have your best interests at heart. Despite their legal obligation to uphold their fiduciary duty — they may or may not be honest, diligent fiduciaries.

2) No matter how tempting it may be to “play” the “takeover game”, it is likely wiser for you to let “the big boys” play that game on their own:

a. Carl Icahn smelled “blood” early on and become the “public face” of the opposition to Mr. Dell’s lowball offer.

b. Since DELL has been very heavily an “institutional holding” in recent years, the major fund managers/companies have been the main players at the table

3) Take a second look at my earlier table, comparing DELL price action with the S&P 500 Index. I suggest to you that, had you held DELL stock on February 5th, you would have been wise to have sold it somewhere between then and March 25th… and been VERY grateful for the huge profit bonanza you received (vis a vis the December price).

a. By doing the above, you avoided five months of “stagnant investment capital”

b. As you can see, all DELL did after March was move downward;

c. More telling, had you invested your DELL funds into SPY, you’d be up by almost 9%!

4) After selling your stock in February or March, you could have sold puts or purchased calls in a “stock replacement” strategy”.

a. You thereby reduce your capital at risk and increase your cash available;

b. However, because the “battle” has extended five months, the theta decay in long calls could have caused you great frustration, if not loss.

Finally, I can’t resist tying this article up with an overall observation. It is reported that, during the past couple of years, Mr. Dell has become increasing concerned regarding his “legacy”. According to some, that was part of his motivation to pursue taking DELL private. In light of that report, consider what Mr. Dell has succeeded in doing:

1) I never imagined that anyone could ever make Carl Icahn look “good”!

a. Mr. Dell has (amazingly) succeeded in doing just that.

b. Mr. Icahn is not “noble”, nor does he care about other investors (in my mind, his inner character resembles the rich, greedy “Mr. Potter” from “It’s A Wonderful Life”.

c. However, Mr. Icahn prevented Mr. Dell from denying shareholders full value without at least having to win public fight to do so.

2) Mr. Dell tied himself, unknowingly, closer to Mark Zuckerberg than to Steven Paul Jobs within the sacred “Tech Pantheon” of those who invented a tech-related firm in a dorm room or garage.

a. Steve Jobs never tried to steal Apple (AAPL) from his shareholders

i. Experts, commentators, AAPL shareholders, etc. still talk about Jobs reverentially, as though his home is really on Mt. Olympus.

b. Mark Zuckerberg used to be almost universally celebrated as a great, eccentric genius (The Social Network).

i. The Facebook (FB) IPO was a travesty … a tale of arrogance, avarice, and self-aggrandizement of epic proportions

ii. The IPO offering price was $38/share, which implied a market capitalization of $104 billion – almost as high as older, bigger, more profitable Amazon (AMZN).

iii. Take a look at the FB chart. Notice that, after the first day of trading, FB never came close to its IPO price (highest close was about $33/share)– demonstrating how ludicrously high that price was set at.

iv. The IPO was so egregiously manipulated that business schools around the world will be studying the “FB IPO Case Study” for decades to come.

v. As a result, when one hears about Zuckerberg these days, words such as “young”, “manipulative”, “inexperienced”, “overreaching”, “profit-challenged” (especially in the “mobility” space) get used at least as often as “genius”.

c. I may not be alone in thinking the following:

i. Because of the Dell/Silver Lake/Microsoft buyout bid, I will no longer picture Michael Dell in his dorm room, boldly bringing innovation to the computer industry;

ii. I will no longer think of Michael Dell as once the youngest Fortune 500 CEO;

iii. I will no longer picture Michael Dell as standing behind the computers upon which I carried out my daily work;

iv. Instead, I will think of Michael Dell as an extraordinary example of a rich, spoiled entrepreneur who never fully grasped (or accepted) the fiduciary duty which came as a inviolate obligation upon him once he chose to make his fortune by transforming his company into a publically held corporation (and he became CEO/Director). Instead, he chose to conspire with a third party (Silver Lake) for the specific purpose of developing a buyout plan credible enough to be successfully “sold” to shareholders but low enough to avoid exposing him to significant risk. The result was a plan that, compared to the more objective valuation of several long-time experts, underprices DELL by at least 40%. Someone who was not as understanding as I am might even suggest he was trying to “steal” DELL from shareholders “for a song”!

3) Because of all of the above, Mr. Dell may have succeeded in transforming his “legacy” from something of nearly infinite worth to something much closer to the cost of one of the old Dell comic books I so often bought as a child.

DISCLOSURE: Nothing contained in the above is intended as (nor should it be construed as) a recommendation to buy or sell anything. The author has no direct ownership of DELL shares. The author does own options on AAPL, AMZN, and SPY… and has (in the past) owned MSFT and two Longleaf Partners mutual funds.

BONUS CHARTS (all courtesy of YCharts):

1) The chart of DELL and the S&P 500 Index since February illustrates the huge “opportunity cost” any DELL shareholder suffered by holding on to DELL.

2) This chart of DELL book value per share illustrates part of Hawkins’ argument regarding DELL’s valuation.

3) This chart demonstrates that, although DELL has suffered in its return on assets and return on equity metrics (due to being late and ineffective in the “tablet” space), its book value has held up and it still generates good cash from operations.

4) As badly as DELL might be doing because of its failure to “perform” in the tablet space, its return on assets is still better than rival Hewlett-Packard (HPQ) – which has become the poster child for ineffective, foot shooting management.

5) As DELL becomes more focused on tech services (instead of computer hardware), its operations should improve… as suggested by this graph of cash from operations (HPQ in orange; DELL in blue).

Submitted by Thomas Petty MBA CFP

1)

[1] http://en.wikipedia.org/wiki/Board_of_directors

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Prediction: MercadoLibre Stock Will Beat the Market. Here's Why.

Prediction: MercadoLibre Stock Will Beat the Market. Here's Why.