This stock could provide an exceptional alternative strategy for participating in the Alibaba IPO -- without all the volatility and uncertainty!

For those of you who appreciate a challenging trivia question, can you identify the significance of the phrase: “yet another hierarchical officious oracle”?

Here are three related questions:

2) Who created that phrase?

3) When was it first introduced?

4) According to “legend”, what female inspired the development of the phrase?

I wish I had the resources to grant those who scored 100% a great prize! However, I don’t.[1] So to all of you who nailed all four questions – I send you a hearty “High Five”!! (The answers can be found in the APPENDIX at the end of this article.)

As you have hopefully guessed by now, this article focuses upon a 20-year company about which almost everybody has heard, but to which few people are willing to grant the respect and valuation granted to the likes of Amazon (AMZN) or Apple (AAPL), much less Google (GOOG).

Here is a bit of the “back story” of this U.S.-based corporation:

1) In January of 1994, two graduate students studying electrical engineering at Stanford University[2] created a website (a much bigger deal then than it is now) named “Jerry and David’s Guide to the World Wide Web”… a directory of other websites with a hierarchical structure rather than a searchable index. The names of those grad students were: Jerry Yang and David Filo:

- Here is a 1995 photo of David Filo (l) and Jerry Yang (r). [From sfgate.com]

2) Evidently, they soon received feedback about what a geeky title that was, so in les than three months, they renamed it the ever so much superior: YAHOO (see Trivia Question #1 above for its meaning), Emboldened by their creativity, by January of 1995, they created the domain Yahoo.com.

3) The “founding” of Yahoo Inc. (YHOO) is dated with slight differences by Yahoo (January of 1994) and the Wall Street Journal (January of 1995, when Yang and Filo took a leave of absence from Stanford to turn their “class project” into a real business). Jerry and David continued to defy convention by deciding that they would each share the corporate title of “Chief Yahoo”! The firm’s headquarters was established in Sunnyvale, California (where it remains today).

4) By 1996, the Japanese Telecommunications and Internet firm, Softbank (SFTBY), became YHOO’s biggest shareholder. SFTBY, Yang, and Filo agreed to a joint venture – the establishment of a Web product in Japan that serves Japanese Internet users in much the same way that Yahoo was serving U.S. users. That venture, YAHOO JAPAN, still exists today and (in fact) is a greater success than its parent company has been in the U.S.! We’ll be delving later into how significant YHOO’s stake in that Japanese joint venture is for the current valuation of YHOO stock!

5) Also in 1996, YHOO stock was taken public, with each of the “Chief Yahoos” becoming millionaires. [Remember that 1996 came during very period that led up to the “Dot.com Bubble”; demand for such equities was growing fast and furious.]

Anyone who lived during the period between1995 and 2005 remembers that YHOO enjoyed a prominent presence then. As most web directories and search engines did in those days, YHOO added a web portal. By 1998, “Yahoo!” became the most popular point of embarkation into the Web for users of the Internet! As the ramp up into the “Bubble” continued, YHOO reached an all-time high price of $118.75/share [on the second trading day of 2000!] Proving the adage “The Higher they Fly, the Harder they Fall” — within just 21 months, YHOO stock had crumbled downward to just $8.11/share! That amounted to a 93.2% loss!![3]

Some of you younger readers may be surprised to learn that YHOO was, at one point, an Internet pioneer in online search and the online ad business. The reason that YHOO’s “glory years” have been forgotten is simple. Although it was fully 4 and ¾ years younger than YHOO, Google (GOOG) put its act together quickly and started chipping away at YHOO’s market share from the start! The “first step” came in the year 2000, when YHOO started to utilize GOOG for its search engine. [At that junction, YHOO began development of its own, inside search technology; but that technology was not ready for public use until 2004!]

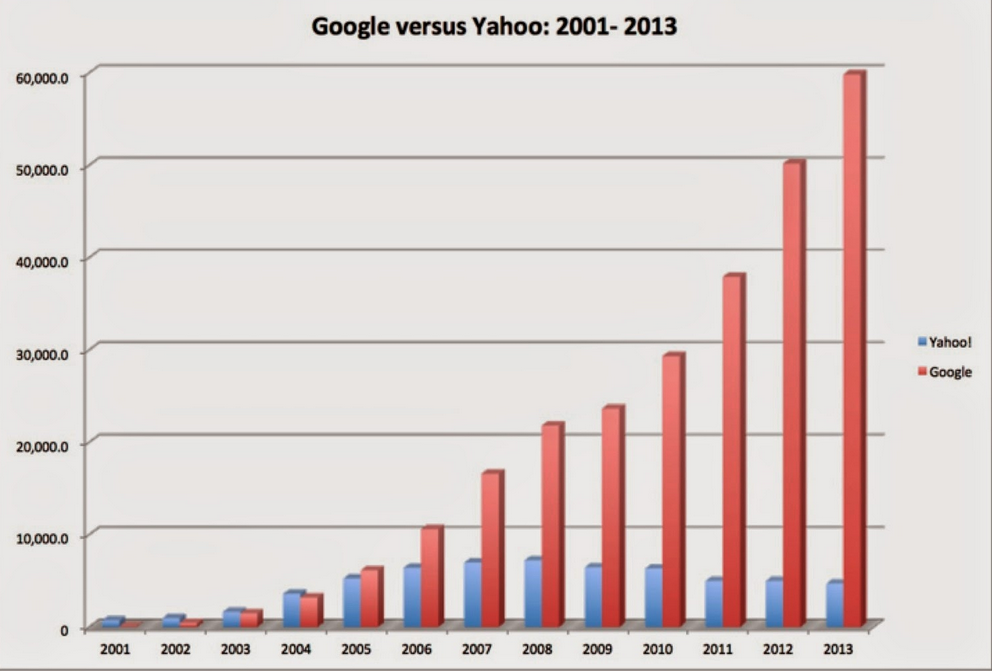

Just as one would expect, the steady rise of GOOG revenue metrics presaged a significant slowing (and then decline) in YHOO revenue!

This chart of GOOG revenue vs YHOO revenue tells a powerful story about the diverging fortunes of the two tech firms!

In the opinion of many thousands of YHOO investors and market observers, the “Nail in YHOO’s Coffin” (to way over dramatize for effect!)… the month that no [then] YHOO investor will ever forget… and the decision that sealed Mr. Yang’s ultimate fate… came in February of 2008! Can you guess what that dramatic, seminal, never to be forgotten development was?

Microsoft Corporation (MSFT) presented an entirely unsolicited bid to acquire YHOO for a total of $44.6 billion! [At the time, that amounted to $31/share in cash and Microsoft stock.] Of course, you can guess what happened! Yang and the YHOO board rejected the offer as being “substantially undervalued” [and “not in the best interest of YHOO shareholders.]

Three years later, the total market cap for YHOO was less than half that buyout offer! (it fell to $22.24 billion). As I was reminded of the tumult surrounding that story, I thought of Carl Icahn… and sure enough, he was on the scene and involved… opining the following through the New York Times: “In my opinion, you might have to get rid of Jerry and part of the board to bring back Microsoft.”[4]

Sure enough, less than 12 months later (January of 2009), Carol Bartz was named as CEO – replacing Yang. With all due respect, if folks were unimpressed by Yang’s leadership from 2007 onward, it is safe to say that Bartz did not outshine Yang! It was during Bartz’s watch that the brouhaha over Alipay occurred… a development that left the best minds within the corporate and financial world variously befuddled or astounded. Given her uninspiring leadership, it was no surprise that Bartz was removed in September of 2011, and CFO Tim Morse was named Interim CEO. Months later, Scott Thompson was pronounced CEO and rumors of large layoffs began to surface.

In the denouement of what surely were the “darkest” days in the history of YHOO, Thompson was ousted as CEO by May 13, 2012, after just 130 days in office!! Making that situation appallingly worse was the report that Thompson’s total compensation for those 30 days of work totaled $7.3 million![5] Replacing Thompson on an interim basis was Ross Levinsohn. That means that YHOO endured five CEOs between December of 2008 and May of 2012… a revolving door indeed!

By that point, the YHOO Board was moved to try a new approach in CEO selection – choosing to hire a former Google (GOOG) executive (with a highly touted tech space “rep”), Marissa Mayer, as President and CEO of YHOO. Mayer took charge of YHOO on July 17, 2012, and the Board did her the favor of cutting 14% of YHOO’s total head count during the three months prior to her arrival![6]

Besides having a camera-friendly visage, Mayer also proved to be one of those CEOs who can “move markets”, as this graph demonstrates:[7] [YHOO is in red; the S&P 500 is in blue… so YHOO jumped 70% in one year after Mayer’s ascension to the CEO position.]

YHOO is in red, the S&P 500 Index is in blue. Needless to say, the ascendance of M. Mayer as CEO of YHOO made a huge impact upon YHOO's price!

To illustrate the breadth of YHOO’s product lineup, here is a partial list of what it offers, on a global basis:

1) Web portal

2) Yahoo Search (a search engine), including related services such as the following:

Yahoo Mail, Yahoo Directory, Yahoo News, Yahoo Finance.

Yahoo Groups, Yahoo Answers, Advertising

Yahoo Online Mapping

3) Partnerships with multiple content-providers on products such as: Yahoo Sports, Yahoo Music, Yahoo Movies, Yahoo Weather, Yahoo News, Yahoo Games.

4) In particular, it partners with Apple (AAPL) as the provider of “Mapping”.

5) Of course, it provides a “personalization service” for users to combine their favorite Yahoo features and news onto a single page (as is common these days).

It is worth offering a brief recap of one of the many failed decisions initiated by Mayer’s predecessors. In September of 2011, YHOO entered into an ad selling partnership with two of its biggest competitors: Microsoft and AOL. It may have been a reasonable idea, but not long after Mayer’s arrival, she found that the results from that partnership were quite disappointing.[8] Mayer discovered that a prime reason for the partnership being a disappointment was that, instead of being a faithful partner, Microsoft merely skimmed off four percent of the search market from YHOO, while making no constructive efforts to increase the partnership’s combined market share![9]

In August of 2013, a report from comScore showed that during July, so many more folks in the U.S. visited Yahoo Web sites that, for the first time in 26 months, YHOO surpassed Google (GOOG) on that important metric! Specifically, 196 million U.S. visitors accessed Yahoo Web sites – an increase of 21% in just one year!

A footnote within that comScore report provides segue into a brief summary of a few of the changes Mayer has brought to YHOO. That footnote highlighted the exclusion from the above Yahoo Web site “July visits” metric of that month’s visits to Tumblr! Why is that significant?

- One of Mayer's first purchases was TUMBLR.

That reference was significant for two reasons:

1) It recognized that YHOO purchased the blogging site (Tumblr) on May 19th (2013) for $1.1 billion… filling YHOO’s “[need for] a thriving social networking and communications hub”[10]; and

2) It confirmed what became a new trend among large tech space companies – namely, the acquisition of start-up Internet companies (even though not sizable generators of revenue) in order to “connect” with fast-growing online communities.

In fact, three months later, YHOO bought RockMelt, a social Web browser company, and (although not an acquisition) it announced a partnership with Yelp, Inc. on March 12, 2014 – in hopes that YHOO’s local search results would be improved vis-à-vis GOOG.

One special note of interest is the fact that (relative to Tumblr) one of the first purchases by Mayer (in March of 2013) was of a little company that cost her just $30 million! That company was Summly. The especially noteworthy aspect of Summly (besides its basic description: a summarization, artificial intelligence technology) is that its CEO/Creator, Nick D’Aloisio, was just 17 years old as of the date YHOO purchased it! D’Aloisio became a valued member of the YHOO team, including being placed in charge of the Yahoo News Digest, which has received recognition for its high quality.

Founder Nick D'Aloisio has become an important addition to the YHOO team... and therefore is as valuable to YHOO as the purchase of his creation: SUMMLY!

That development highlights one particular aspect of the Summly, Tumblr and RockMelt purchases that I think is often neglected by the average investor. In each case, along with incorporating all of those start-up companies, YHOO (and Mayer) gained the benefit of the experience, insights, networks, and support of leaders such as David Karp (Tumblr CEO), as well as Eric Vishria (CEO) and Tim Howes (CTO) (from RockMelt), and D’Aloisio. Vishria, Howes, and D’Aloisio have been incorporated into the YHOO management team, while Karp will remain a large shareholder.

Meanwhile, D’Aloisio was interviewed on CNBC during the recent Apple (AAPL) Developers Conference (WWDC). The focus of that conversation was on ways in which YHOO partners with AAPL – such as on the IOS mobile platform. AAPL’s iOS weather app pulls data from Yahoo Weather, and Apple's stocks app pulls from Yahoo Finance. D’Aloisio was excited about the possibility of growing that partnership, and it would seem he has the props to contribute in expanding upon that relationship. The Wall Street Journal awarded him an “Innovator of the Year” award, and Time Magazine has honored him as one of the world’s most influential teens, as well as profiling him in their “Secrets of Genius” publication.

Because of Mayer’s leadership, the media has jacked up its spotlight on YHOO and its stock. One especially fascinating recent moment in the movement of YHOO stock came this past April, when YHOO reported flat revenue and declining earnings. What do you think happened to the stock price following that report? As you know, the normal expectation for a stock price following a decline in earnings and (especially) a report of flat revenue would be for the price to decline.

However, following that less than sterling earnings report from YHOO, the stock price jumped up! How did YHOO get so lucky that it received special treatment? The “secret” is YHOO’s asset value!! Let’s take a look at the excellent analysis of Dr. Aswath Damodaran[11] regarding a fair valuation for the stock of YHOO. That analysis is made much easier because (as we have seen) he has already completed an extensive analysis of one of YHOO’s underlying assets: Alibaba Holdings (of which YHOO holds a stake of just over 22%).

There is more good news about YHOO! You may recall (from earlier) that YHOO partnered with SFTBY in 1996 to create YAHOO! Japan (TYO; Toyko Stock Exchange). YHOO retains a 35% share in the ownership of YAHOO! Japan.

![]() So let’s take a quick, “big picture” look at this company! It is headquartered within Tokyo’s “Midtown Tower” complex. After almost two years of operation, the company’s stock was listed on the JASDAQ exchange. As a result of its impressive performance and growth, during January of 2000, the company’s stock became the first stock in Japanese history to trade for more than 100 million Yen per share!

So let’s take a quick, “big picture” look at this company! It is headquartered within Tokyo’s “Midtown Tower” complex. After almost two years of operation, the company’s stock was listed on the JASDAQ exchange. As a result of its impressive performance and growth, during January of 2000, the company’s stock became the first stock in Japanese history to trade for more than 100 million Yen per share!

The next public evidence of the steady rise of respect and esteem for the success of Yahoo! Japan within the corporate and financial circles of Japan came in October of 2003, when its stock became listed on the Tokyo Stock Exchange (ticker: TYO). Just two years later, TYO stock reached the milestone of becoming included within the prestigious Nikkei 225 Index. And for those readers who are sports fans, TYO obtained the naming rights for the Fukuoka Dome in 2005 (home to the Fukuoka Softbank Hawks baseball team). The stadium became named the Fukuoka Yahoo! Japan Dome.

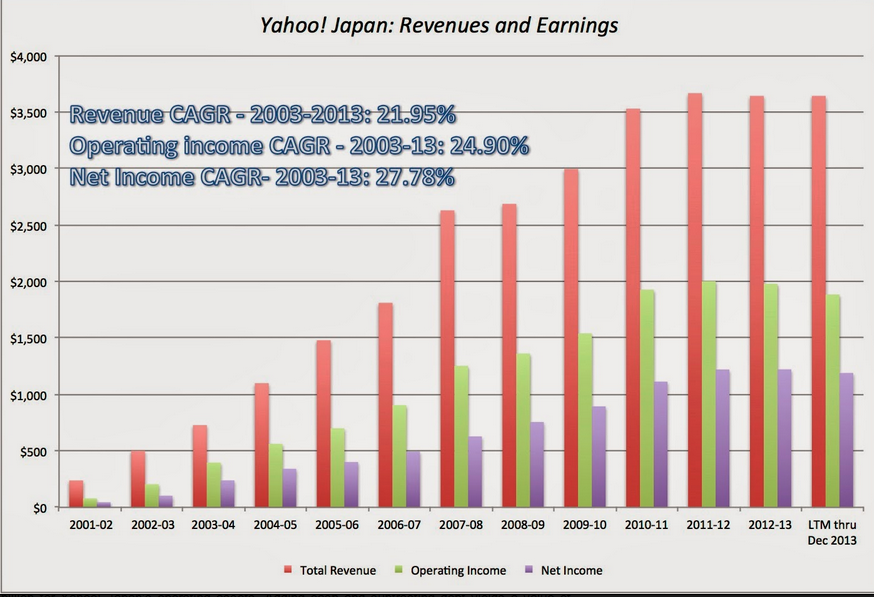

As we have seen, the “U.S. Yahoo” saw its “glory years” between 1996 and 2008. Then (along with the entire U.S. economy) YHOO struggled from 2009 onward. In contrast, Yahoo! Japan has thrived throughout this period,[12] with the exception of a slowdown in 2012 and 2013. Here is a graph of Revenue and Earnings trends between 2001 and 2013:

As you can see, in spite of that recent slowdown, the revenue/income trends during this past decade have been solid, with “Compounded Annual Growth Rates” (CAGR) between just under 22% and almost as high as 28% (as shown above).

Given the healthy financial metrics and growth rates for TYO, Damodaran’s “Relative Value” methodology projected a figure of $34.188 billion, versus an “Intrinsic Value” of $20.997 billion.[13] [14]

At this point, I ask that you “hold onto” this information regarding Yahoo! Japan. I also refer you back to the detailed look we presented regarding the fair value for Alibaba Holdings in a prior article: How To Value An Anomaly Of Market Share And Growth. We will soon incorporate that background information into a comprehensive analysis that will project a fair value for YHOO.

What do you suppose the operating assets of YHOO are worth?[15] As we begin, we need to clarify that YHOO does not “consolidate” its financial statements. What this means is that the Revenues and Operating Income figures reported by YHOO do not take into account the financial metrics of either Alibaba or Yahoo! Japan.[16]

We won’t present the intricate detail of the calculations used by Damodaran for YHOO valuation, but remember that he uses three primary methodologies:

1) Intrinsic Value

2) Relative Value

3) Market-Price

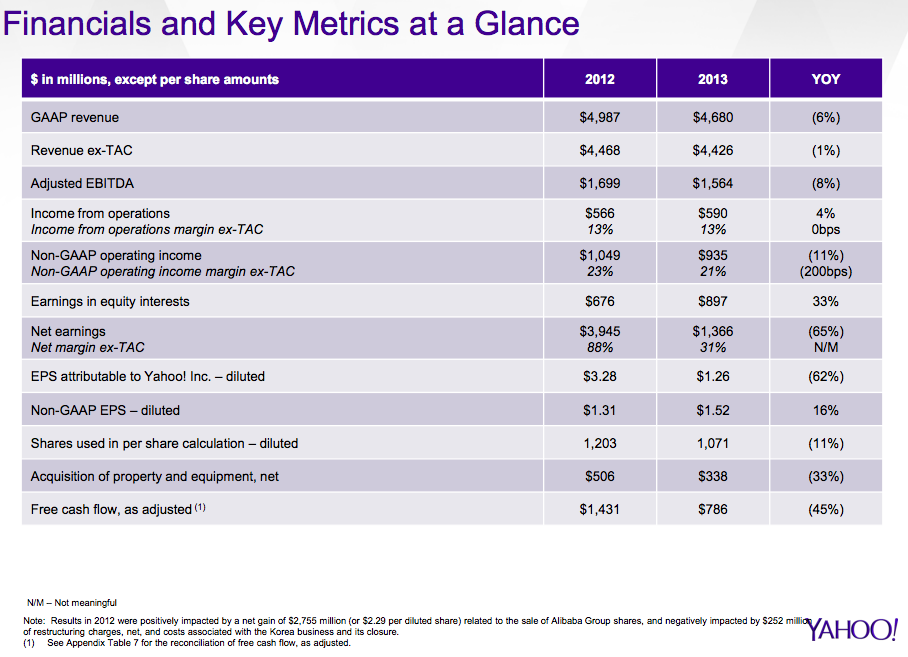

From among the wide range of YHOO’s financial metrics, it is worth noting that, during 2013, YHOO reported that its “Income From Operations” totaled $590 million, with the “Pre-Tax Operating Margin” coming in at 12.6% (reported as 13% — see that line from the published YHOO financials below, where the left column is for 2012 and the right is 2013).[17]

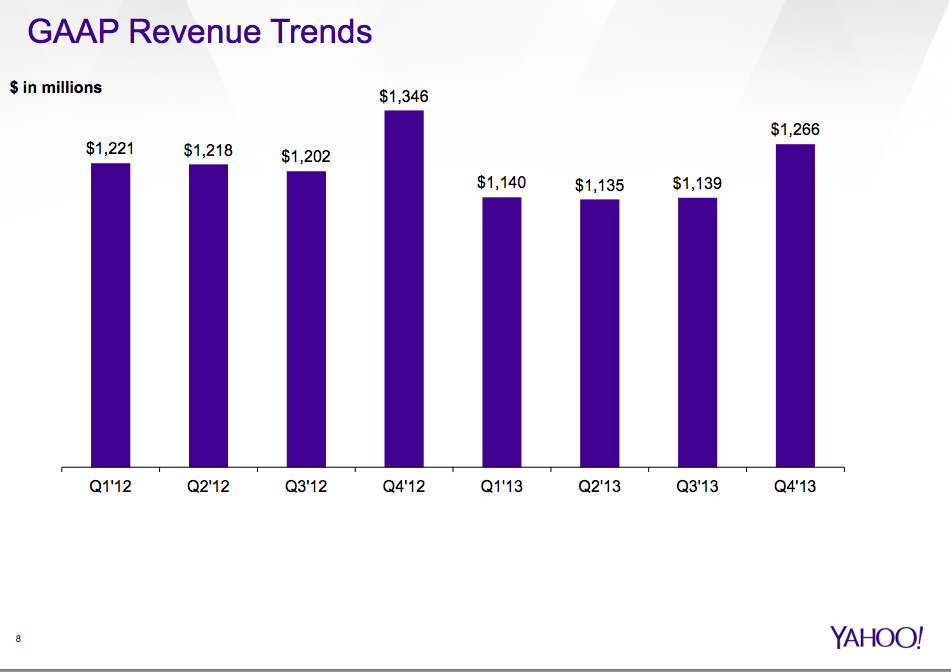

Take a good look at this graph from YHOO’s posted Financial Statements: GAAP Revenue Trends.

I’m sure you’ll agree that this graph bears no resemblance to the revenue trend of a growth company.

That is why, for his calculation of an Intrinsic Value for YHOO, Dr. Damodaran utilized the assumption of nominal 1% growth over the next five years. His methodology produced a value for Operating Assets of $4.38 billion.

To complete this calculation, he took YHOO’s Cash ($4.6 billion), subtracted its Debt ($1.6 billion), and added the net figure to the Operating Assets for a total Intrinsic Value of $7.38 billion.

RELATIVE VALUE:

As you’ll recall from our article on Alibaba, this method involves applying financial multiples from comparable industry competitors to certain key financial metrics from the company in question (YHOO). As he did with Alibaba, Damodaran focused on the EV/Sales ratio and EV/EBITDA ratio for YHOO. [18]

However, unlike the assumptions of growth that Damodaran utilized with Alibaba, he identified YHOO as a “mature” company (see the Revenue Trends above). Therefore, he adjusted the Internet Software/Services Industry multiples downward for the calculation of YHOO’s relative value. Specifically, he applied the EV/Sales Ratio (using a growth rate of 1% and an operating margin of 9.02% (slightly lower than 2013)) of 0.63 to YHOO’s revenues ($4.672 billion) – resulting in an Enterprise Value of $2.948 billion.

As before, he then added the “Net” figure above (Cash less Debt) to arrive at a Relative Value of $5.9 billion.

MARKET PRICING:

In May, when YHOO was priced at $33.76, it boasted a Market Capitalization of $34.8 billion.

At this point, you should be wondering: “Wait a minute! Something is wrong here! The Market Cap is over $27 billion greater than the Intrinsic Value shown above… and almost $29 billion higher than the Relative Value! What’s up with that?”

As Sherlock Holmes might say: “Elementary, my dear reader. Elementary!”

Recall that the calculation of YHOO’s first two valuation figures depended intricately upon the company’s operating financial data! That data included no operating inputs from Yahoo! Japan or Alibaba, within which YHOO holds a significant stake. Therefore, we have two additional values to add to each of our first two valuation calculations.

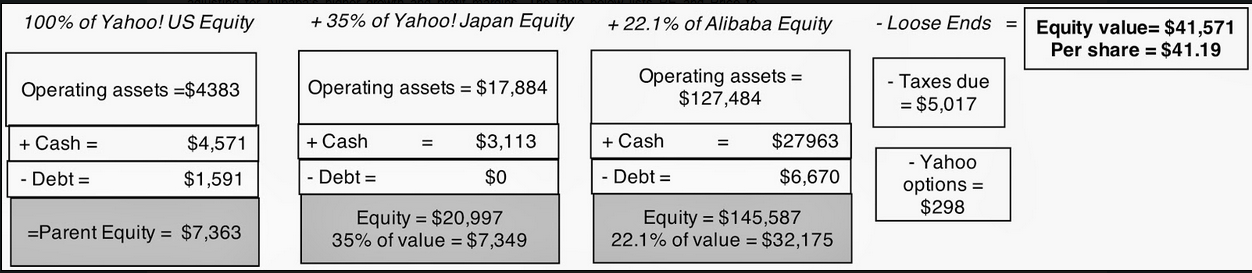

Fortunately for us, Damodaran summarizes those calculations very simply and clearly for us, as follows:

As laid out above, YHOO’s INTRINSIC VALUE, with all assets included, is $41.57 billion, or $41.19/share!

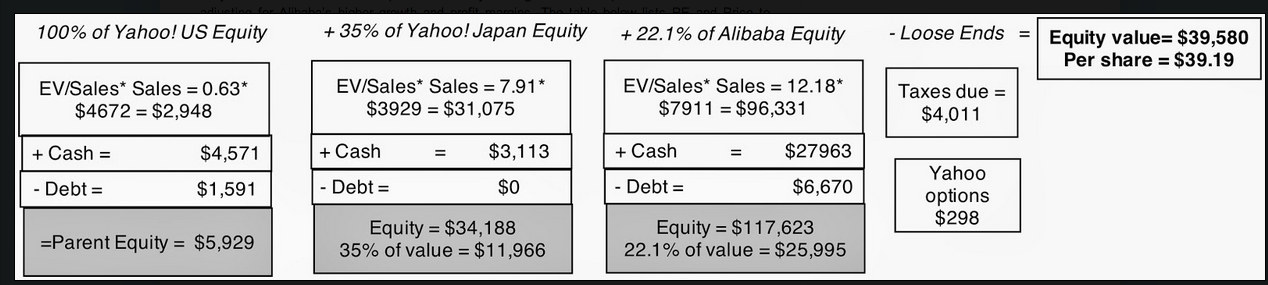

In similar fashion, here is the summary for RELATIVE VALUE:

Therefore, YHOO’s RELATIVE VALUE, with all assets included, is $39.58 billion, or $39.19/share!

Given all of the above, do any trading ideas come springing to mind? I’ll give you a minute to mull that over.

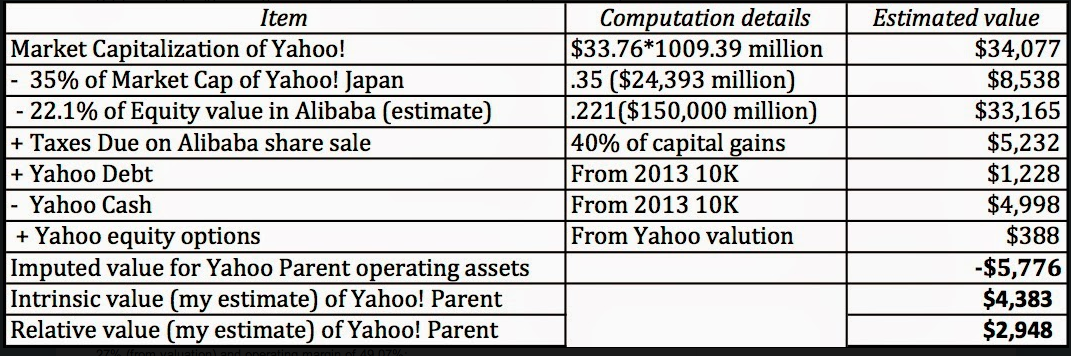

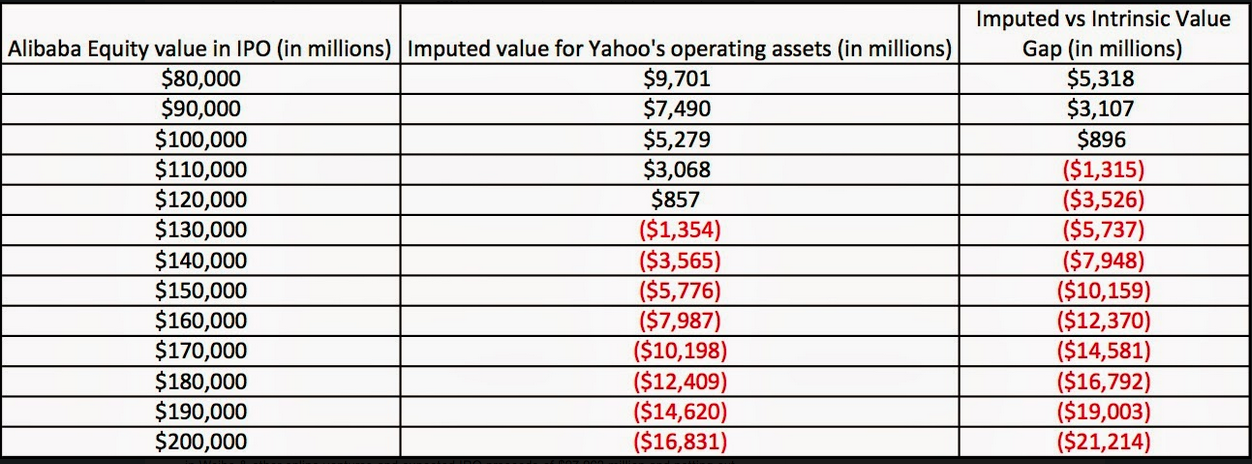

While you are reflecting, take a good long look at this worksheet, which I consider Damodaran’s “masterstroke” regarding his analysis of YHOO! First, what is the objective of this worksheet? It is very simple: he starts with YHOO’s current market cap, then backs out (ie. subtracts) the values we have already discerned for TYO, the Alibaba IPO, and Cash; then he adds back in Taxes Due, Debt, and Equity Options. The result is the theoretical value that the market is placing upon the value of the “Parent Company Operating Assets”.

Anyone with eyes to see will recognize immediately that the market currently places a negative value on Marissa Mayer, her team, and the operating assets of YHOO. Does that help you to brainstorm some trading possibilities?

Finally, here is a very helpful summary from Damodaran regarding how to analyze YHOO as we look forward to the [August] Alibaba IPO. You can see above that he has been assuming that the IPO will come off at a price that would imply a total value for the company of $150 billion. In contrast, most of the estimates I have been seeing in the press reach up to $168 billion (or higher)…. so Damodaran is wisely using a more conservative number!

However, what if the IPO comes off at a higher price than currently expected? To put it mildly, someone who is fond of Las Vegas trips and prefers to bet “with the odds” would fully expect Alibaba’s IPO offering price to be higher than expected.[19]

The worksheet below demonstrates that, as long as the IPO comes off at a price that implies a total company value of at least $104 billion, the market is currently undervaluing YHOO stock!

Just imagine what would happen if the IPO comes off at a level that implies that Alibaba is worth more than $150 billion!

INVESTOR TAKEAWAY:

I hope that this article has brought you value – by providing you with a broader and deeper perspective through which to understand YHOO. The “glory days” of YHOO are long past. To say that the $44.6 billion buyout offer from MSFT was a “lost opportunity” is a gross under statement.[20] YHOO has become a mature technology company with a steady, but largely flat, revenue stream.

The “difference maker” in YHOO stock is the “legacy” that remains from very wise investments from the past: TYO in 1996 and Alibaba in 2005! In fact, as we have seen above, the value of those two investments amounts to five times the value of the parent company’s own operating assets!!

If we take a look at the current YHOO price chart, we can see that YHOO continues to be underpriced, relative to the valuation work of Damodaran, and (YTD) $33/share has been a strong support level[21].

Our readers know that I never tell you what to do – with regard to investments or anything else.[22] In that context, let’s wonder aloud what strategy might be appropriate IF you believe that YHOO is undervalued at current levels:

1) An obvious option would be to buy the stock outright;

2) A second option could be to apply a “Covered Call” strategy (recognizing that you give up any future profit above the call strike price);

3) A third option would be to sell a “Bull Put” – finding a combination of strike price and expiration month with which you are comfortable.

A reasonable “Exit Plan” would be to hold through the Alibaba IPO event, unless you must exit earlier due to some very negative YHOO news or due to a general market collapse.

Obviously the hope would be that the Alibaba IPO goes off in a way that far exceeds current expectations. If that happens, your bullish YHOO position could serve as a form of equity “lottery ticket” on Alibaba. What I mean in particular is this:

If you are intrigued by Alibaba and want to participate in the IPO event, but you are wary of the unpredictability and volatility of IPO’s… one of the above strategies would provide a (much) lower risk method of benefiting from any “upside” on Alibaba.[23]

DISCLOSURE:

I have owned YHOO in the past, as I have SFTBY and MSFT. I currently own many such stocks through ETFs, but not directly. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

Let me add that while all investments involve risk, investing in YHOO includes at least two particular risks:

1) If the Alibaba IPO is blocked or postponed (for reasons I cannot anticipate), market disappointment will inevitably impact the YHOO stock price.

2) If the Alibaba IPO is extremely successful, but Ms. Mayer takes that opportunity to draw billions in cash out to purchase more companies, that may not receive a warm reception among shareholders. As we have learned in countless cases within the past few years, a major theme on Wall Street has been the importance of delivering “value” to shareholders. That has been a recurring theme among “activists” (Icahn, Ackmann, etc.) as well as financial commentators.

Therefore, Ms. Mayer may need to resist the temptation to try to create “her legacy” by buying YHOO into some form of greatness again. If instead, she returns “value” to shareholders through increased dividends, a special dividend, and/or more share buybacks, the impact upon YHOO stock will be more constructive. At the very least, Ms. Mayer should consider some solid “balance” between company growth and shareholder value (in other words, she needs to be a “good steward of capital”!).

APPENDIX:

The answers to the TRIVIA QUIZ at the beginning are:

1) Yet Another Hierarchical Officious Oracle is the foundation of the famous acronym that identifies one of the world’s biggest Internet platforms: Y.A.H.O.O. or YAHOO

2) The two persons who created the phrase (and acronym) were Jerry Yang and David Filo (the founders of YAHOO).

3) The acronym was first introduced on January 18, 1995.

4) David Filo’s college girlfriend frequently referred to David as a “yahoo”!! Variations on this aspect of “Yahoo Lore” include the founders’ own statements regarding their mutual fondness for the slang definition of a “yahoo”… a term that (evidently) commonly crossed the lips of college students during the late 1980’s and early 1990’s in reference to the stereotyped image of rural Southerners, which usually meant and of the following: “rude”, “uncouth”, “unsophisticated”.

Finally, as a free literary education “bonus” for those of you who have read this far, “Yahoo” also refers to a legendary being in the novel Gulliver’s Travels (1726) by Jonathan Swift. In the book, “Yahoos” are filthy beings with unpleasant habits… that resemble human beings. Here is an image created by Louis John Rhead titled “The Servants Drive a Herd of Yahoos into the Field”. [Source: Wikipedia]

FOOTNOTES”]

[1] Not to mention that I don’t have access to any reliable (ie. time sensitive) feedback technology.

[2] Beware electrical engineering majors.

[3] That loss brings to mind the 1963 mega-hit “Wipeout” by the Safaris. .For all of you born after 1963, here is the soundtrack: https://www.youtube.com/watch?v=gG2naf70MbY If you demonstrate tendencies toward “Las Vegas” style option trading, I suggest you keep that link handy and play it when your long call or long put option expires worthless.

[4] The gist of Icahn’s opinion was that Yang had so infuriated and alienated Microsoft that the only way a new, revised offer bid would ever come would be if Yang was “out the door”. Icahn was not a happy camper, having been a holder of YHOO stock! [Which begs the question: “Is Icahn ever a ‘happy camper’?”]

[5] Somebody please fire me and reward me with $7 million!!

[6] Projected to save about $375 million in annual expense.

[7] If nothing else, the “baseline” for YHOO CEO was pretty low by the time Mayer followed her five predecessors. By comparison, Mayer was a “shining star”!

[8] The partnership underperformed in both market share and revenue.

[9] Could that be the strategic genius of Steve Ballmer at work?

[10] An opinion published in the Wall Street Journal at the time of the acquisition.

[11] He is a Professor of Corporate Finance and Equity Valuation at the Stern School of Business within New York University.

[12] TYO has even (as of this month) established a U.S.-subsidiary business, YJ America, Inc. Discover the details here: http://finance.yahoo.com/news/yahoo-japan-establishes-us-based-180000305.html;_ylt=AwrBEiKGXJJTomcAHBWTmYlQ

[13] Recall from the article on Alibaba Valuation that valuation calculations can vary quite a bit – depending upon the assumptions made, the financial year from which financial data is drawn, and the passage of time.

[14] Note as well that the market cap of Yahoo! Japan (in May 2014) was $23.2 billion.

[15] To clarify what I mean by “Operating Assets”… if you strip YHOO’s stake in Alibaba and its stake in Yahoo! Japan out of YHOO stock, what would the value of all that remains be?

[16] It might interest you to know that the YHOO financial statement does include Alibaba and Yahoo! Japan inputs within the sections covering Net Income and Book Value of Equity.

[17] The entire page from those YHOO financials is included in the Appendix.

[18] A reminder: “EV” stands for “Enterprise Value”

[19] As we pointed out in our IPO article, that has become habitual in big name IPO’s.

[20] An argument could be made that, much as Gettysburg was the “High Water Mark” of the Confederacy, that MSFT buyout was the “High Water Mark” of YHOO.

[21] Which should be no surprise.

[22] I confess that I do direct you to take a “Quiz” now and then… or look at a chart… but I think we’ll all agree that those instructions are strictly related to helping you absorb article content.

[23] The most perceptive among you will also realize that utilizing Softbank (SFTBY) in much the same way may be worth considering. It owns 35% of Alibaba. You will need to perform your own due diligence on SFTBY – which combines an operating base, supplemented by investments in many technology concerns (especially Asian ones).

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Is IonQ Stock a Buy?

Is IonQ Stock a Buy?