Some great long-term investors overcome the quote from John Templeton that they are "Doomed to failure".

WHO IS THE GREATEST INVESTOR?

Let’s start with a trivia quiz:

Among publicly known investors who have engaged in trading for at least 40 years, who is the greatest investor? [Note: the 40-year requirement eliminates David Swenson from qualifying for this honor – since he started in 1985. We highlighted Swenson in this recent article: https://www.markettamer.com/blog/the-best-investment-manager-you-dont-know-and-the-illiquidity-premium ].

Now you might be thinking: “I know that answer! In fact, everybody knows that answer!!”

But I caution you – this is not as easy a question as you may think!

So, given your knowledge of long-lived publicly known investors, please answer these questions:

1) Was the “greatest investor” born in:

a) Omaha, Nebraska

b) Alton, Illinois or

c) Park Ridge, Illinois[1]

2) Where did the “greatest investor” receive the first post high school degree:

a) University of Kansas

b) Brown University

c) University of Nebraska – Lincoln

3) From which school did the “greatest investor” receive the highest post-graduate degree:

a) Keller Graduate School of Business

b) Columbia Business School

c) Northwestern University

4) The “greatest investor” served for a time as a professor at the University of California?

a) True

b) False

5) The “greatest investor” was engaged for a few years in top-secret research projects for the U.S. Department of Defense:

a) True

b) False

6) One of the strongest characteristics of the “greatest investor” is total commitment to abiding by a consistent, long-term investment plan, and long-term adherence to fundamental investment principles – through all the ups and downs of market cycles:

a) True

b) False

7) The “greatest investor” demonstrates an uncommon commitment to serving the interests of investor clients by:

* Aligning their interests with the interests of investors/clients

* Providing timely and accurate performance and accounting reports

* Being honest and transparent

a) True

b) False

[See appropriate answers in the APPENDIX].

So how do you think you did?

Was the quiz too easy?

It wasn’t hard to pick out the answers that applied to the internationally renowned investor – the “Oracle of Omaha”, “Wizard of Wall Street”, etc. I refer, of course, to the affable and always quotable, Warren Buffett. As everyone knows, he bought out a failing textile company named Berkshire Hathaway in 1964. Then, over the course of the following decades turned it into an international conglomerate that, according to Forbes, was the world’s fifth largest company in 2014!

Here is a stock chart of Berkshire Hathaway A-Shares (BRK.A) since 1984:

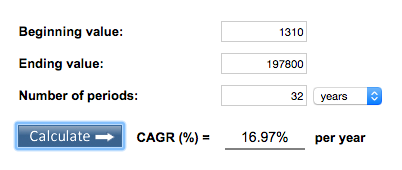

Between January of 1984 and the end of 2015, the Compound Annual Growth Rate (CAGR) of BRK.A was almost 17%!! Pretty outstanding, eh?[2]

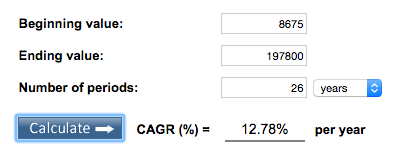

Between 1990 and the end of 2015… BRK.A offered a CAGR of 12.78%:

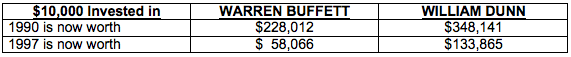

If one had invested $10,000 in BRK.A in 1990, she/he would have had $228,012 at the end of 2015. I think I’d be thrilled with that return – wouldn’t you?

During the most recent 19 year period (January 1997 through December 2015), BRK.A provided investors with a CAGR of just over 9.5%:

If one had invested $10,000 in BRK.A nineteen years ago, she/he would have had $58.066 at the end of 2015. Not too shabby!!

So, my MarketTamer.com friends, are we agreed that Warren Buffett is the greatest investor who has been trading for at least 40 years?? After all, based on the frequency of financial media headlines that incorporate the revered and iconic name “Buffett”… the U.S. media certainly has ordained Warren Buffett as the long-time “greatest investor”!

I see most all of you nodding your head “Yes”.

But wait!! Maybe we’ve been too hasty!!

I have just been given performance data on another “40-year plus” fund manager.

I can’t believe this!! Buffett has been trumped, thumped, and now bumped from the very top of the “Mt. Olympus of Fund Managers”! It is almost as though the very foundations of the investment world have been shaken to the core!!

Look at these investment performance figures for one William Dunn… compared to those of the venerable and revered Mr. Buffett:

|

$10,000 Invested in |

WARREN BUFFETT |

WILLIAM DUNN |

| 1990 is now worth |

$228,012 |

$348,141 |

| 1997 is now worth |

$ 58,066 |

$133,865 |

Now that is a surprise!! At least it is a surprise to me!

Hmmm…. I hear you thinking: “Who in the world is William Dunn?”

Great question!

William Dunn was born in Alton, Illinois in 1934. He graduated in 1960 from the University of Kansas with a degree in engineering physics. Then, within six years, he earned a PhD In “Theoretical Physics” from the prestigious Northwestern University in Evanston, Illinois.

Following graduation, he was a professor in Physics at the University of California and Pomona College. Then Dunn moved on to employment by the U.S. Defense Department (DOD) … engaging in top-secret operations research in systems analysis. Unfortunately, when Dunn reflects on that stage of his career, he says: “I found the work entirely tedious.”

By 1970, while still with the DOD, Dunn discovered a pursuit that seemed much more intellectually stimulating to him that DOD top-secret physics research:

The U.S. Stock Market

Dunn began applying all of his education and experience in research and complex mathematical analysis (from physics) to the world of finance…. focusing upon the stock market. He was committed to the development of a trend-following system using historical price data to determine whether to go long or short.

However, in his (then) “pre-PC” world[3], Dunn came to the conclusion that there were far too many individual stocks to follow for one to be able to maintain genuine and functional focus. His other disappointment was the apparent absence of any single “authority” (either broker or analyst) who demonstrated a credible systemic understanding of the overall dynamics of the market. As Dunn recalls now: “I had no confidence in any of them.”

Then, Dunn had a break through! He read a newsletter that laid out opportunities within the commodity market — through which one could accumulate money.[4] That article motivated him to begin a detailed (and determined) study of technical analysis. Dunn set his focus upon the development of a system that would apply to all commodities. This was the result, as described by Dunn:

“There were only two dozen futures traders doing that back then. I could keep track of the prices in my head, for heavens sake. And guess what? It worked.”

By October of 1974, Dunn and his small group of associates developed confidence in his research on commodities. In the aggregate, his friends, family, and co-workers pooled $137,000 to create an account for full-time trading within just eleven markets.

“After several years of studying the possibility that recent past history might be suggestive of future market performance, research showed that it was. I shared this approach with my associates and together we walked bravely into the future.”

Dunn’s initial trading algorithm was constructed with only two parameters… and yet his average return since 1974 has been approximately 15%.

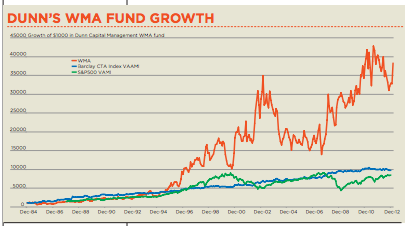

Performance of Dunn's WMA Fund vis-a-vis the Barclay CTA Index and the S&P 500 Index between Dec. 1984 and Dec. 2012.

Dunn and his associates expanded their focus in 1984 by rolling out their primary fund vehicle — World Monetary Assets (WMA). According to Futuresmag.com (published September 2015):

“A $100,000 investment in 1984 in Dunn's WMA program …. would be worth more than $4 million today.”

All I can say is: “If only…..”

It is noteworthy that the WMA Fund still utilizes Dunn’s original trend-following algorithm created in 1974!!

Another key date in the evolution of Dunn Capital Management, LLC was 2006, when one of Dunn’s smaller commodity funds (focused on agricultural contracts) was folded into the original WMA to become the World Monetary and Agricultural Programme. Because of that combination – the number of futures contracts traded through that “flagship” fund increased to 53 (from 26).

As one might expect of a physicist, Dunn’s investment approach has always been research intensive – with algorithms based upon exhaustive mathematical formulae and data analytics. He trusts his “system”… not human emotion or “instinct”.

Using its research and data intensive analytic capabilities, Dunn’s fund significantly modified its investment management approach during that key transitional year of 2006. A key Dunn investment manager has recently explained this modification:

“At the time [prior to 2006] we were using three parameters for each of the 26 markets we traded. We would look at each market on an individual basis.

“In 2006 we had been researching for about three years and it became evident to us that it wasn’t important how each individual market did standing on its own. What was important was how the portfolio as a whole performed.

“[Therefore] Instead of using just three models for each market we started using portfolio-wide models, and went from three to a 100 or more.”

Then Dunn folded the two funds together as described above. In that light, the Dunn manager continues his description:

“At the same time we folded in all these other markets as liquidity grew due the increase in electronic markets, thereby allowing us to trade larger AUM, especially in the agricultural sector. It was very evident you could get better risk adjusted performance by combining a large number of non-correlated markets which provides better diversification and therefore a more robust revenue stream.”

As you can clearly see, Dunn Capital Management, LLC is always on the lookout for ways to better manage risk and improve risk-adjusted returns for their clients. In fact, over the past four decades, one of the more interesting developments within Dunn’s history is its approach to risk management. Through these years, Dunn has depended upon a risk model designed to respond to changes in market volatility. That model is referred to at Dunn as the “Value at Risk” (VaR) model. Here is an example of how it works:

A target risk profile is determined;

The system buys 500 gold contracts;

If volatility increases, the position is trimmed by 10- 30 contracts in order to better control the overall portfolio risk;

Dunn achieves this by utilizing a macro overlay that mimics a VaR at the portfolio level;

At that point, in Dunn’s words: “We try to stay that course.”

Before we move on with the story of Dunn Capital Management, LLC, I need to introduce another key player at Dunn:

Martin H. Bergin:

Born in 1960;

Graduated with a BS in Business Administration from George Mason University in 1987;

Became a CPA in 1988;

Worked for two public accounting firms from 1987 through September of 1997, when he was hired at Dunn Management.

Bergin clearly impressed Bill Dunn… since Dunn almost immediately began to grant Bergin increasing responsibility through the following years. At present, Bergin is the person appointed by Dunn to succeed him at whatever future point Dunn retires (or becomes incapacitated).

Being an accountant, one can understand Bergin’s affinity with Bill Dunn, who from the start (1974) has built his business upon systemic analysis and data-intensive research. Therefore, since Bergin’s arrival, he has played a key role within the evolutionary tweaking of the Dunn investment system. Bergin recently shed light upon how Dunn has (over time) adjusted its risk management discipline.

As hinted within the earlier description of the VaR model, Dunn Management views risk based on the likelihood of losing a significant amount of money within any particular timeframe (as measured via VaR). From the investment firm’s start, Dunn’s risk model was designed to limit risk to a one percent chance of losing 20% or more in any rolling one-month period. In its long history, it has managed to remain quite close to this VaR target. Although it may sound strange to those of us not as adept in higher mathematics, that works out to an annual volatility within the fund that ranges between 34 and 36%.

As pointed out earlier, investors have tolerated such volatility because of Dunn’s remarkable long-term record. However, recent years have witnessed a diminishment of investor tolerance for risk (ie. a measurable increase in “risk aversion”). Therefore, by January of 2013 (after extensive research and analysis), Dunn made some adjustments. As Bergin describes it:

“Since 1974 the industry as a whole has been reducing volatility. We basically stayed the same. The industry currently, on average, is about a third of the volatility that we are.”

The system’s modification is called “ARP: Adaptive Risk Profile”. Here is a description by Bergin:

“For a number of years we’ve been thinking about how to control downside volatility without giving away upside returns. With ARP, the [fund] looks at the risk of the marketplace and systematically determines whether to target the VaR at 20 per cent or trade at a measure less. In other words, changing the level of risk based on how we perceive the market. Our average VaR, instead of being 20 per cent, is now closer to 15 per cent.”[5]

Bergin continued:

“This is evidenced by the fact that in 2014, the [fund] is down -5.77 per cent through April but the VaR is approximately 14 per cent.

“At the start of the year that figure was around 17 per cent. Last year, the VaR ranged between 20 per cent and 12 per cent. We ramped up the volatility early in the year and made strong returns in February. Indeed, through the first four months of 2013 we were at a new high.”

Commenting on overall fund volatility, Bergin observed:

“And our volatility would come down from close to 36% to something in the neighborhood of 23%. The goal here is to provide increased risk adjusted returns, and provide the investor with something that’s a little different than others in the industry are doing. We’re trying to address the needs of the investors. The outcome should be performance similar to what we were already providing with a reduction in downside volatility. We’re not giving away any performance, yet reducing the downside risk.”

That particular comment [ie. “to provide increased risk adjusted returns”] touches upon what I consider to be two particularly laudable characteristics of Dunn Capital Management, LLC:

1) Dunn, Bergin, and their employees have a significant portion of personal wealth invested in Dunn funds – right alongside their clients’ funds! Therefore, investor interests are fully aligned with the interests of Dunn management!

2) Dunn’s compensation is strictly performance based! There are absolutely no annual management fees. What this means is that during years in which Dunn funds have lost money, Dunn has received no revenue. Talk about an incentive for management to always give clients “their best”!! Just one more way to align the interests of investors with those of Dunn management.

A William Dunn quote from a recent interview emphasizes his customer-centric approach to his business:

“I am not only a trader, but also an investor, and I have always tried to manage the business from the investor's perspective. That is, I often ask ‘what would the investor want or expect?’ And that's what I do.”

At this point, if I were reading about William Dunn for the first time, I would be thinking: “This guy is way too good to be true. Petty is making all this stuff up!… There has to be ‘a Catch’ somewhere!!”

Well, in the interest of full disclosure, there is, indeed, “a Catch”!

Remember when I mentioned in passing that Dunn funds were more volatile than the average commodity fund? Well, if you are an investor with a low tolerance for a string of losing months, then William Dunn is quite likely not going to be your “manager of choice”!

Drawdowns[6] within Dunn funds can be alarming for those who are a bit skittish regarding investments.

|

Persistence of Monthly Drawdown |

Frequency |

| Two losing months in a row |

41 times |

| Three losing months in a row |

14 times |

| Four losing months in a row |

11 times |

| Five losing months in a row |

4 times |

|

Year |

Biggest Losing Stretch |

Performance for that Year |

|

1994 |

-36.75% |

-19.32% |

|

2000 |

-44.18% |

+13.07% |

|

2004 |

-43.11% |

-16.39% |

|

2005 |

-29.86% |

-16.39% |

|

2007 |

-40.03% |

+ 7.94% |

|

2011 |

-22.64% |

+ 6.37% |

|

2015 |

-16.85% |

+15.82% |

As you might guess from the above table, Dunn hit a genuine “dry spell” early in the first decade of this century.

Here are monthly performance figures from 2000 through 2015. Note the dry spell between 2003 and 2005!

Although all of the above is extremely relevant and enlightening with regard to Bill Dunn as an investor, I must point out a timeless truth often repeated (and emphasized) by none other than Warren Buffett:

…. every investment strategy will go through an occasional period of underperformance and/or loss. The key requirement for a successful investor is to stick to her/his investment discipline [one that has demonstrated long-term success] and not succumb to the temptation of emotional investment decisions.

In this regard, Bill Dunn has been a sterling example of discipline and resolve. Between 2003 and 2005, during an extended stretch of negative annual returns, Dunn never gave up, never wavered, and never lost faith in his system.

What makes Dunn’s resolve all the more remarkable is the fact that, during those years with negative returns, Dunn Capital Management, LLC was operating without revenue![7] And even more startling, “Assets Under Management” (AUM) dropped from $1.5 billion to just over $100 million!

Despite all these discouraging developments, Dunn hung in there and persevered. For that perseverance, his faith was rewarded!

According to BarclayHedge data, DUNN made money in 2006 and 2007, was up over 50% in 2008, and lost just half of a per cent in 2009 when the industry as a whole posted losses (especially the big players).

During 2010, Dunn’s primary fund generated a positive return exceeding 30%; while during 2011, it generated 6%.

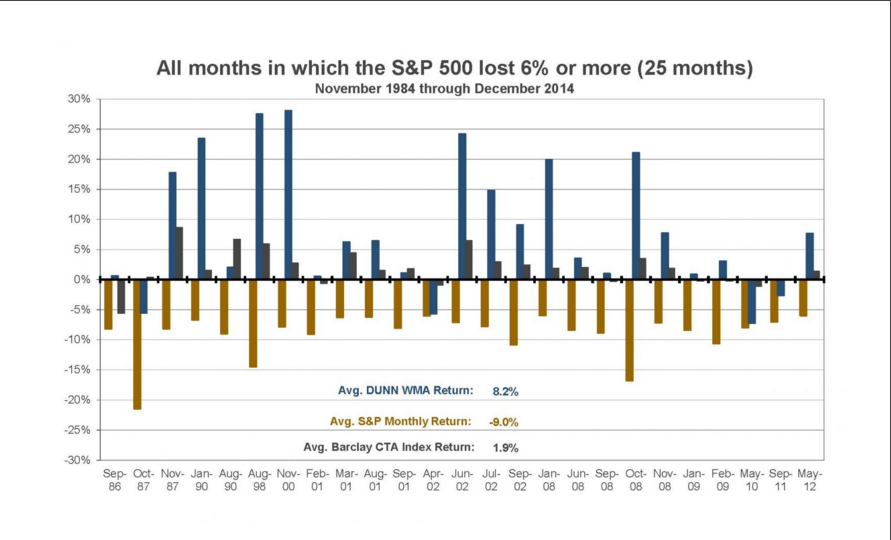

It is intriguing to note that, despite the obvious volatility exhibited by Dunn’s funds, the following graph offers a surprising view of its overall “risk” vis-à-vis the returns from the S&P 500 Index and the Barclay CTA Index[8]:

Since October of 1984 (when the Dunn WMA Program began trading), the S&P has lost more than 6% in a single month on 25 occasions. The average performance of the S&P 500 Index during those months was -9.0%. During those same months. the average return generated by the Barclay CTA Index was +1.9% while the performance of WMA was an outstanding +8.2%.

Just as important as relative risk, the above chart also demonstrates quite powerfully the positive impact upon a portfolio of adding Non-Correlated Assets. As described in our recent article on Asset Allocation and the Efficient Frontier… within most investment environments, adding some Non-Correlated Assets to a stock and bond portfolio can significantly enhance the portfolio’s risk-adjusted return! [See: https://www.markettamer.com/blog/asset-allocation-dysfunction-or-diversification-lost-in-the-shuffle ]

Another plus of the Dunn Capital Management, LLC approach to money management is its strict, rigorous adherence to a proven system. As Bergin explains:

“Everything we do is 100% systematic. There’s no over-ride, no individual decision-making whatsoever. That is the focus of the firm.”

In fact, it has been that way since 1974 – back in the early years of computing, when trading research such as Dunn’s had to be laboriously programmed into a huge mainframe computer through IBM punch cards. In fact, intensive computing in those years was so expensive that time on a mainframe server had to be “rented” – generally on a weekly basis.

Over the years Dunn has tweaked the model, but for the most part he has stuck to the original game plan. He has a material amount of his own net worth committed to his system, and he has never felt the need to sweet-talk clients into investing with Dunn, even during the dark days of 2003 to 2005.[9]

Regarding the investor-centric approach of William Dunn, Ted Kingsbery of CTA Liberty Funds Group (who has known Dunn since 1981) says this:

“No one talks more straightforwardly than Bill Dunn. He’s an impressive guy. You know he believes in his system — he lives it.

“[He] issues his statements on the first of the month (the fastest I’ve ever seen) and the figures, no matter how ugly, will be honest.”

Although this image comes from www.hawk-financial-group.com (not on the Dunn website), it does summarize Dunn's attitude regarding his responsibility to Dunn clients.

Finally, it cannot be emphasized enough that Dunn Capital Management, LLC adheres to a highly investor-friendly compensation policy. Bergin describes it this way:

“One of the key philosophies of our firm is we want to be on the same side of the table as the investor. We invest our capital in the same programmes right along with our investors and we don’t charge a management fee as we don’t want any conflicts between us and the investor. Therefore, when the investor makes money, we make money. And if the investor doesn’t make money we don’t make money. It’s been the same since Bill founded the firm in 1974!”

INVESTOR TAKEAWAY:

I confess that the title of this article was, albeit unintended, a “trap”. As I researched and composed the article, it became clearer and clearer to me that there is no way to empirically determine … in any overall, general sense… who the “Greatest” Investor actually is (or was)!!

The reason is (as Sherlock Holmes would say) “elementary”. “Greatest” is an adjective which is entirely subjective – not all that different from other comparative adjectives such as “Most Beautiful”, “Brightest”, “Most Creative”, “Smartest”, “Most Charming”[10], etc.

Now if we redefine “Greatest Investor” as meaning any of the following:

1) Highest CAGR during any given period;

2) Best risk adjusted return over any given period;

3) Best “Alpha” or “Sharpe Ratio” over any given period;

4) Most often quoted investor during any given time period (that honor, of course, would currently go to Warren Buffett… although Jeffrey Gundlach [see: https://www.markettamer.com/blog/gundlach-on-the-feds-amazing-blunder ] is definitely “trending” in that category!!.

For now, if we consider the periods shown below, it is apparent that (at least for those periods) William Dunn surpasses Warren Buffett as “Greatest Investor” vis-à-vis “return on invested dollars”!

However, at the risk of being branded a heretic within the world of investment professionals, I posit to you that there is much more to investing than merely “return on invested dollars”!!

For example, if all of my assets had been invested with William Dunn in 2003, 2004, and 2005, how well would I have slept?? I assure you that the resounding answer is: “Not well at all!”

In fact, within my current circumstances, I would be utterly content if a money manager could (and would) assure me that my average annual return (net of all fees and expenses) would be 5%! As that manager delivered consistently on that promise, I would sleep like a baby!! And (investment world, please forgive me!!) I might easily consider that manager to be the “Greatest Investor”… because for me, he or she would be exactly that: simultaneously meeting my financial needs and providing me with peace of mind[11]!!

So, allow me to summarize what I consider to be the most salient points above:

1) There can be no objectively determined “Greatest Investor” without a specification of clear-cut, empirical criteria upon which such a judgment will be determined;

2) The CAGR Calculator is a handy tool to use in comparing the relative “return upon invested dollars among various funds or managers;

3) Risk-adjusted return metrics are also very important – particularly when evaluating what investment fund or investment style best suits the risk tolerance profile of any given investor;

4) When choosing a manager, one should always insist upon the following:

a) A manager who aligns her/his interest perfectly with your interest!

b) A manager who is transparent and reports results accurately on a timely basis.

c) Special consideration should be given to any successful manager who forgoes an annual fee … and instead earns money only when you earn a positive return during any given year!

d) A manager who has an exceptional long-term investment record, uses a system (or investment strategy) to which she/he adheres unwaveringly, and who has unshakeable faith in that system/strategy!

e) A manager who consistently exhibits objective, operational utilization of risk management systems and practices.

5) If I had a portfolio to allocate to professional managers, I think an extremely sound and logical first step would be decide how much of those assets to allocate among (at least) the following:

a) An “Emergency Fund” of totally liquid assets available at all times to meet unexpected financial needs.

b) An investment in Warren Buffett’s Berkshire Hathaway (BRK.A) stock… not because it has done well lately (it hasn’t) but because few others have demonstrated their investment acumen over the long-term as compellingly as has Mr. Buffett.

c) An investment in William Dunn’s WMA Fund program. As I am sure you’d agree, the story I have laid out above is extremely impressive. Dunn’s fund is not correlated to the stock market (or BRK.A) and would be a great diversifier to improve risk-adjusted return.

DISCLOSURE:

The author has taken positions in BRK.A in the past, but has never had money invested with William Dunn (whom he learned about just one month ago). It goes without sating that the author has positions within various iterations of the S&P 500 Index. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

APPENDIX:

Although we agreed that there is no objective “Greatest Investor”, I provide you with informative answers related to this article below:

1) Was the “greatest investor” born in:

a) Omaha, Nebraska (Buffett was born there)

b) Alton, Illinois (Dunn was born there)

c) Park Ridge, Illinois[12]

2) Where did the “greatest investor” receive the first post high school degree:

a) University of Kansas (Dunn graduated from there)

b) Brown University

c) University of Nebraska – Lincoln (Buffett graduated from there)

3) From which school did the “greatest investor” receive the highest post-graduate degree:

a) Keller Graduate School of Business

b) Columbia Business School (Buffett received his MBA from there)

c) Northwestern University (Dunn received his PhD from there)

4) The “greatest investor” served for a time as a professor at the University of California?

a) True (Dunn served as a professor)

b) False

5) The “greatest investor” was engaged for a few years in top-secret research projects for the U.S. Department of Defense:

a) True (Dunn worked for the USDoD)

b) False

6) One of the strongest characteristics of the “greatest investor” is total commitment to abiding by a consistent, long-term investment plan, and long-term adherence to fundamental investment principles – through all the ups and downs of market cycles:

a) True (Dunn has been a sterling example of such commitment)

b) False

7) The “greatest investor” demonstrates an uncommon commitment to serving the interests of investor clients by:

* Aligning their interests with the interests of investors/clients

* Providing timely and accurate performance and accounting reports

* Being honest and transparent

a) True (Dunn has a track record of all of the above).

b) False

FOOTNOTES:

[1] Lest you think Park Ridge is inconsequential, it was where Hilary Rodham Clinton was raised.

[2] CAGR is a measure of the growth of an investment over multiple time periods. You can find a very useful (and user-friendly) CAGR Calculator at http://www.investinganswers.com/calculators/return/compound-annual-growth-rate-cagr-calculator-1262 ; it also offers a bit more detail about CAGR.

[3] Although computers existed, all programming had to be done through punch cards… and the computing process was much more labor intensive, slow, and tedious than it is today. To put it mildly, trying the analyze the stock market in the detail a theoretical physicist thought necessary, was just not practical in the early 1970’s.

[4] I find it somewhat ironic that Dunn cannot recall the author or title of that article.

[5] Bergin noted that, following the adoption of ARP… the fund’s VaR range ranged between 20 per cent and 8 per cent.

[6] Drawdowns are simply “a decline in an investment or fund”.

[7] Remember, they only make money when they provide investors with a positive annual return!

[8] CTA is an acronym for “Commodity Trading Advisor”.

[9] In other words, Dunn is no salesman. In fact, he reports that he interviews potential clients as much as they interview him. He tries to ensure from the start that any new investor is committed for the “long-term”.

[10] Although, in all modesty, I think I deserve the nod for “Most Charming”.

[11] The latter is, by the way, a blessing that I defy anyone to adequately quantify in financial terms!

[12] Lest you think Park Ridge is inconsequential, it was where Hilary Rodham Clinton was raised.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why CoreWeave, Quantum Computing, and Digital Turbine Plunged Today

Why CoreWeave, Quantum Computing, and Digital Turbine Plunged Today