You have seen us often reiterate the importance of a holistic approach to investing, because investing involves far too many dimensions and variables for any simplistic strategy to regularly result in profit.  One example of this is a principle espoused by 20th Century investment giant, Benjamin Graham,

One example of this is a principle espoused by 20th Century investment giant, Benjamin Graham,  whose seminal books on stocks[1] inspired 21st Century investment giant (and by far the most frequently used “icon” within investment education marketing efforts) Warren Buffett – to go to Columbia Business School in the early 1950’s[2], work for Graham in the mid-50’s, and then venture out on his own in the financial world, connecting with the now famous Berkshire Hathaway (BRK-B) long before anyone had an inkling that “Berkshire” could refer to anything except a beautiful range of mountains in western Massachusetts![3]

whose seminal books on stocks[1] inspired 21st Century investment giant (and by far the most frequently used “icon” within investment education marketing efforts) Warren Buffett – to go to Columbia Business School in the early 1950’s[2], work for Graham in the mid-50’s, and then venture out on his own in the financial world, connecting with the now famous Berkshire Hathaway (BRK-B) long before anyone had an inkling that “Berkshire” could refer to anything except a beautiful range of mountains in western Massachusetts![3]

The oversimplified version of the Graham/Buffett principle is: 1) find great companies with solid financials and above average growth potential; 2) buy said companies at a reasonable price[4]. That is a great operating principle; however, most of us are not accountants or Chartered Financial Analysts (CFA). We get “lost” pouring over audited financial statements. Now we could depend on analysts from brokerage houses, but are they truly “independent”? We could also pay a subscription service to provide us with detailed financial analysis of attractive companies (if we have the extra cash).

Fortunately, at this point, we have an affordable, reliable alternative! The ETF industry is a veritable “buffet”[5] of investment information because ETF managers are required to regularly disclose portfolio components! With regard to the Graham/Buffett investment principles, one ETF in particular stands out: the Market Vectors Wide Moat ETF (MOAT). We covered this ETF in some detail on August 13 (https://www.markettamer.com/blog/how-to-find-stocks-with-economic-moats) and covered the portfolio rebalancing it had completed just weeks before. The most startling adjustment MOAT made in during that rebalance was the addition of Facebook (FB), which the Morningstar analysts considered greatly undervalued[6] in June ($24.81 on July 1st). Morningstar valued FB in the $33-34 range.

Of course, as we know in hindsight, once FB reported its (now infamous) “blowout earnings”, the stock started heading toward “the moon”. The day after the publication of our article, FB stood at $36.65;[7] but FB price movement did not stop there. It headed upward until it conquered $50 (to a closing high of $50.42 on 10/1).

What do you suppose the Morningstar analysts think of FB now? Before you answer, remember that the analysts are focusing on what they see in the financial reports, not the daily gyrations within the market. They know (barring fraud) that “the financials don’t lie”; and they know that the market is fickle. I like to think of the Morningstar folks as serving the same purpose within the investment world as these scientists[8] serve within our space exploration program – they examine the key parts, processes, and systems “up close and personal” so we will have an accurate, comprehensive assessment of actual “conditions”.[9]

What do you suppose the Morningstar analysts think of FB now? Before you answer, remember that the analysts are focusing on what they see in the financial reports, not the daily gyrations within the market. They know (barring fraud) that “the financials don’t lie”; and they know that the market is fickle. I like to think of the Morningstar folks as serving the same purpose within the investment world as these scientists[8] serve within our space exploration program – they examine the key parts, processes, and systems “up close and personal” so we will have an accurate, comprehensive assessment of actual “conditions”.[9]

Because of the ETF “open disclosure” regulation, we can “peek” into the extensive data produced through Morningstar regarding their weighting of strong financials and favorable valuation. As a huge bonus, the MOAT ETF throws in[10] the “competitive advantage” metric of a wide economic moat!! If you aren’t fully conversant with the “economic moat” concept, I suggest you re-read https://www.markettamer.com/blog/how-to-find-stocks-with-economic-moats, or if you prefer videos, look at http://www.vaneck.com/Library/viewpoint-videos/?video=634715508160738068.

So getting back to my question about FB, the Morningstar folks still consider FB quite favorably with regard to financial strength, favorable future earnings growth, and their “wide moat” – however (and a big “however” it is) the price for FB has (some weeks ago, in fact) moved beyond any reasonable valuation measure! Those analysts stand by their projection of “fair valuation” at around $34/share. Oooops!

Therefore, MOAT rebalanced FB right out of the portfolio at the end of the quarter. There are, of course, no regrets about having held FB during the 3rd quarter!! Look at this graph (below) of the relative performance of MOAT and FB during the 3rd quarter! (MOAT is in blue; FB is in green). FB moved higher by over 100%, helping to lift MOAT upward by 10.7%!! So all MOAT shareholders offer FB a grateful “Thank YOU”… but MOAT has executed a vey public “Un-friending” of the company that created the term. FB is no longer found within the MOAT portfolio, and won’t be again until its financials can justify a $50 price![11]

One other note before we move on from FB: On October 9th, a block of 6,000 option contracts in FB (selling the January 2014 36 strike put) was executed at the bid price of $1.48. That was the session’s largest trade – so large that IV gained 3.3%. That trade indicates what anyone would call “conviction” that FB will be sitting above $36/share when the January put options expire. One could presume the seller is counting on strong support at $36, a level FB has not broken since the end of July.

Let’s return our full attention to MOAT. What other stocks were rotated out of the portfolio and replaced? Here is a list (below):

A stock can be removed because of negative changes within the financials or (as with FB) price moving far enough ahead of valuation that it is no longer as appealing as one of the other stocks on the MOAT watch list.[12]

A stock can be removed because of negative changes within the financials or (as with FB) price moving far enough ahead of valuation that it is no longer as appealing as one of the other stocks on the MOAT watch list.[12]

The graph below shows the 3Q price action of MOAT compared with five of the components that were removed this past quarter. Notice that all but Maxim (MXIM) matched or exceeded MOAT by the end of the quarter!! (MOAT blue; Qualcomm (QCOM) dark green; National Oilwell Varco (NOV) brown; Schlumberger (SLB) light green; MXIM purple; Amgen (AMGN) red/pink).

Knowing that Caterpillar (CAT) did not exactly have a “banner quarter” price-wise, you may wonder why it got dropped. This is a case of the analysts discerning a deterioration of its “fair value” due to the update of its financial analysis. Fair value was decreased from $98/share to $94/share.

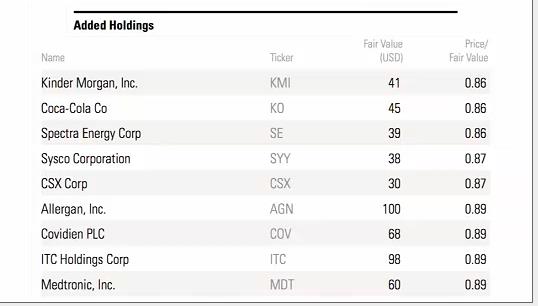

With which stocks did MOAT replace these nine stocks? Below is a list of the new additions:

It would take far too long to touch on each of these stocks, so please forgive me for only touching on a couple of the most notable choices:

It would take far too long to touch on each of these stocks, so please forgive me for only touching on a couple of the most notable choices:

1) Coca Cola (KO) is a longtime favorite of Mr. Buffett; obviously recent price action has brought it back into favorable valuation territory;

2) Kinder Morgan, Inc. (KMP) has had a rough time because, as a high dividend MLP issue, it has been buffeted by the “Taper Terrors” since May. It too has moved downward enough to become “a value”. (See graph below of its price during the past three months).

3) CSX Corp. (CSX) may be the most important and interesting new addition – for the simple reason that the Morningstar folks have been studying the six top railroad stocks for quite some time (railroads have an obviously wide moat). Up until now, they considered the “financial future” of these companies with some suspicion. Now, however, they have turned positive on these six stocks, with the best mix of finances and value being found in CSX. [13]

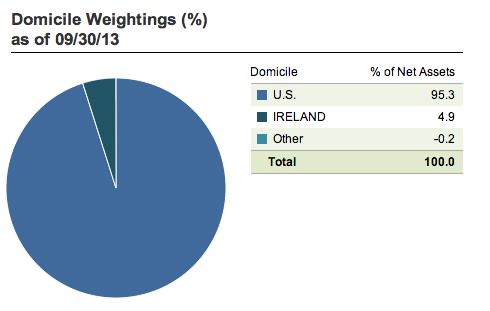

4) My personal favorite new addition is Covidien PLC (COV). Going through the data available about MOAT, I was struck by this graph (Domicile Weightings):

Striking, isn’t it??!! Almost 5% of MOAT is based in Ireland!! Guess which company is Irish?? You got it!! It is Covidien (COV)!

Striking, isn’t it??!! Almost 5% of MOAT is based in Ireland!! Guess which company is Irish?? You got it!! It is Covidien (COV)!

If you have 5-10 minutes, go to its home page! I confess to being a crusty old cynic; but even I was impressed by how impressively they communicate their business, their products, and their vision of their future. One of the most important product lines they produce is designed to help speed the treatment of, and recovery from, strokes – a medical condition for which speedy, appropriate treatment is crucial. In light of that, consider this screen shot (below)–

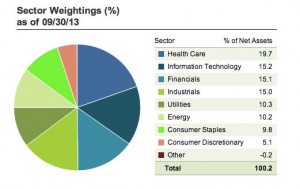

Another key metric you will want to know about MOAT is the SECTOR ALLOCATION. The graph appears below and suggests that Morningstar currently finds (within its watch list) the best values within Healthcare!

Another key metric you will want to know about MOAT is the SECTOR ALLOCATION. The graph appears below and suggests that Morningstar currently finds (within its watch list) the best values within Healthcare!

In fact, one of MOAT’s three “best values” within the portfolio is a Healthcare related stock—Express Scripts (ESRX). At the time of this rebalance, Morningstar said that ESRX was selling at a discount of over 25%. What is most interesting about that is that ESRX had started the quarter at a 15% discount. However, the new, even more appealing valuation, is not due to price decline, but to a 22% jump up in “fair value”!![14]

The other two “best values” are Exelon (EXC) and Western Union (WU) – the former sitting at a 28% discount and the later at about a 26% discount. (Remember, “value” does not mean – buy it and it will go up!!)

The other two “best values” are Exelon (EXC) and Western Union (WU) – the former sitting at a 28% discount and the later at about a 26% discount. (Remember, “value” does not mean – buy it and it will go up!!)

Here are some more resources for you.

A graph of MOAT vis-à-vis the S&P 500 Index for the full period since MOAT first traded:

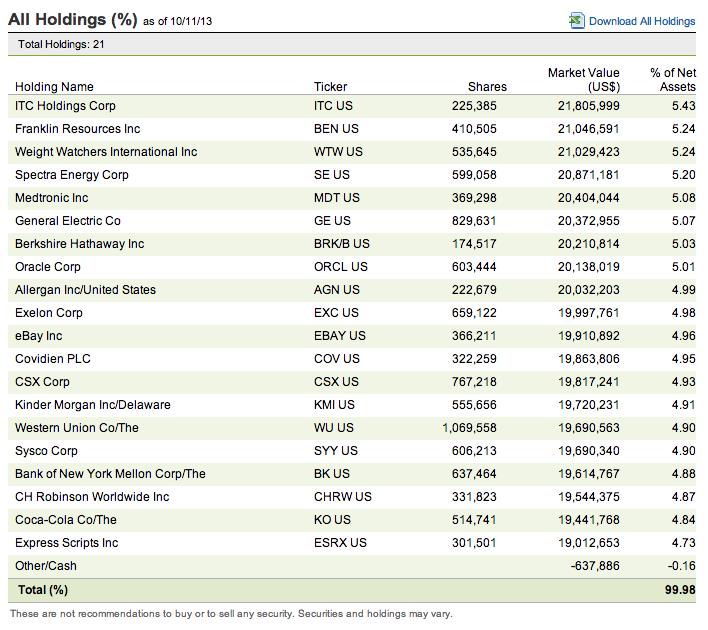

List of the “top ten holdings”:

List of all stocks in MOAT’S portfolio:

Here is a great video regarding the recent rebalancing – highlighting the “why” behind a couple of deletions, as well as the “why” behind some additions (particularly CSX): http://www.morningstar.com/cover/videoCenter.aspx?id=613859&SR=EVZ128

No matter how you regard Wall Street and its most famed and frequently heard from personalities, do yourself a favor and watch this video. I guarantee it will warm your heart, give you an extremely warm and engaging perspective on Benjamin Graham, and actually illustrate how utterly touched and deeply impacted Warren Buffett has been by Graham's personal qualities (not just Graham's wisdom)!!

http://www.youtube.com/watch?v=W8ceZlU1dHg

INVESTOR TAKEAWAY: For all of us “average” folks who are not Chartered Financial Analysts and who can not afford to pay someone to provide us with comprehensive financial analysis reports, we could do much worse than to pay attention to where the experts at MOAT are finding good companies at a reasonable price – with a wide economic moat thrown in for free!!

If nothing else, you could add one or more MOAT portfolio component into your personal watch list and then “buy” whenever the price seems to be close to support. (Then place a stop below your purchase price based on your own personal trading rules.) Obviously, there is no guarantee of profitable trades. But reason dictates that you’ll do much better trading good companies that are priced at a reasonable valuation than you will buying speculative stocks based on “Taper” or “No Taper” or (worse) “it can’t go anywhere but up”.

DISCLOSURE: The author is currently “light” on stocks due to the undependability of Washington DC. The author has owned EXC, KO, KMP, CSX, and COV in the past. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

Submitted by Thomas Petty MBA CFP

[1] Securities Analysis(published 1934) and The Intelligent Investor(published 1949). Just imagine Graham writing that first book during some of the darkest days of the worst U.S. Depression (and stock market crisis) in history!

[2] Buffett earned his MBA and Graham was his favorite professor. Buffett once described himself as “85% Graham”.

[3] The Berkshire Mountains, per Wikipedia: “is a highland geologic region located in the western parts of Massachusetts and Connecticut.” It is an area ripe with education (Williams College) and culture (great live theater).

[4] The principle even suggests (before you “buy”) to pretend you are buying the entire company and then asking yourself if you truly think you got a good value at that price.

[5] Or “buffett”…. yes, pun intended!

[6] At least a 25% discount.

[7] The graph shows the price action between August 14 and now.

[8] The scientists in the image to the left are inspecting the secondary mirror in the (hopefully) space-bound Webb Telescope… the successor to the Hubble! It is fitting we use the image, since Congress almost axed the Webb mission in 2011 after $3 billion had been spent. It is one of the only remaining sizable NASA programs remaining.

[9] Note that, to my knowledge, the Morningstar folks do not wear the sterile white suits!

[10] At no extra cost, no less!

[11] Adding a touch of irony to MOAT dumping FB from its portfolio is the news this week that FB CEO, Mark Zuckerberg, just created his own private “moat” around his private residence by paying $30,000,000 for the four homes that surround his property!!

[12] It could also “lose its economic moat”; but that is not a frequent development.

[13] Morningstar is late in becoming a “railroad” fan! Warren Buffett purchased one four years ago, and Bill Ackman started entering a big position in another railroad some time ago (see our recent articles about Bill!).

[14] From $73 to $89.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Atlassian: A High-Quality Software Company With AI Tailwinds

Atlassian: A High-Quality Software Company With AI Tailwinds