Newcomers to the world of options tend to be fascinated with the leverage that options afford. They are eager to buy a near-term out-of-the-money long call and watch it rain down profits. Unfortunately the likelihood of that happening is low. Beginners would be much better served focusing on an options strategy called the debit spread.

A debit spread is an options trade where you buy one option and sell a less expensive option in the same month. You would treat this pair of options together as one trade.

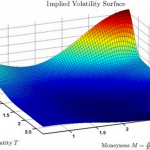

There are two advantages to using debit spreads over simply buying a call option. First, if you buy a call option, the value of that option will decay over time. Every day, you are losing money through decay. With a debit spread, the decay of the option that you bought is offset by the decay of the option that you sold. The second problem with buying a long call to take advantage of a stock that is rising in price is that the implied volatility of the option could fall, reducing the profits. In a debit spread, the impact of fluctuating implied volatility is also minimized.

Let’s look at a quick example. Suppose you were bullish on Amazon (AMZN) and bought a 60-day long call (May 260) for $14.70. If the price of AMZN rises 2%, you might expect that your option would also rise. The theoretical price would be $17.50 for a gain of 21%. But that option also decays over time. If you factor in the decay over 30 days, the price would be $13.18 for a loss of 10%. And if implied volatility falls 2% as well, the option would be worth $12.62, for a loss of 14%.

What if we used a debit spread instead. We will buy the same May 260 Call for $14.70, but also sell the May 265 Call for $12.10, for a net debit (or cost outlay) of $2.60. We will buy 5 spreads so that the total cost is roughly the same as the long call only example ($13.00 vs. $14.70). If AMZN rises 2% in a month, the options would be worth $14, for a gain of 7%. If we factor in the same decay and implied volatility drop, the options would be worth $14.70 for a gain of 13%. The options decay actually helps make us more profit, and a drop in implied volatility has no effect at all.

If you find that buying call options is not as profitable as you think it should be, it might be because of price decay and falling implied volatility, two big killers of option profits. The solution, with excellent immunity to both of these problems, might just be a debit spread.

Submitted by: John Marsland

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why EHang Stock Is Gaining Altitude Today

Why EHang Stock Is Gaining Altitude Today